SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to |

GENPACT LIMITED

(Name of Registrant as Specified In Its Charter)

None

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: |

|

|

|

| (2) | Aggregate number of securities to which transaction applies: |

|

|

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

| (4) | Proposed maximum aggregate value of transaction: |

|

|

|

| (5) | Total fee paid: |

|

|

|

|

| |

☐ | Fee paid previously with preliminary materials. | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: |

|

|

|

| (2) | Form, Schedule or Registration Statement No.: |

|

|

|

| (3) | Filing Party: |

|

|

|

| (4) | Date Filed: |

|

|

|

April 10, 2018

Dear Fellow Shareholder:

I am

In these unprecedented times, we are pleased with our performance and trajectory as we help our clients transform their businesses. As in 2020, we continue to focus on both the health and welfare of our employees while acting with urgency to support our clients. Our agility and the dedication of our global workforce has allowed us to rapidly meet the needs of our clients in a time when digital transformation is more relevant than ever.

Our reputation as a trusted long-term partner for our clients is growing as we deliver end-to-end, domain and process-led solutions, leveraging analytics and digital technologies, and help drive change and deliver measurable outcomes. We are proud of the reputation we have built for delivering value and the strong relationships we have built and nurtured, especially in these challenging times.

Our purpose of “the relentless pursuit of a world that works better for people” acts as our North Star as we unlock value for our clients, employees, investors, and communities. Our purpose fuels our passion and drive to improve the world for all of our stakeholders.

Differentiation in an expanding market

Our strategic focus on a chosen set of industry verticals, our end-to-end services, and the targeted investments we have made in digital, analytics, domain, and process have allowed us to be increasingly relevant to our clients. We are in a growth market that remains highly underpenetrated and have seen our total addressable market expand during 2020 in response to macro challenges.

This market expansion is primarily driven by the changing needs of two different sets of clients: 1) existing clients who want to accelerate their transformation journeys, leading to increased engagement with us on more services and in more buying centers than before; and 2) new clients who are now more open to partnerships in order to change and transform.

Our two synergistic routes to market – digitally-embedded Intelligent Operations that we run and deliver for our clients every day and digital and data analytics-led Transformation Services – allow us to meet the demand for our solutions. We are expanding our relationships with our clients into new buying centers such as the Chief Supply Chain Officer, Chief Risk Officer, Chief Growth Officer, Chief Information Officer and others through our focus on relevant services for each. Services we can provide to these buying centers include supply chain services, financial crimes and risk services, sales and commercial services, and financial planning and analysis, all of which are leading to an expansion of our key client relationships helping these clients drive large-scale, end-to-end transformations.

As of the end of 2020, we served more than 25% of the Fortune Global 500, and we continue to expand into new relationships within this client segment. During 2020, we increased the number of relationships with clients having more than $50 million in annual revenue and also signed new client logos that are first-time buyers for our kinds of services, including more mature services like finance and accounting.

We believe the key reasons clients engage with us is our demonstrated success in leading complex, end-to-end transformations leveraging digital and analytics solutions, our deep understanding of industry verticals coupled with process excellence using Lean Six Sigma principles, and our culture of curiosity, courageousness, incisiveness, and integrity all wrapped in client-centricity.

Leveraging our global workforce, we partner with our clients to design innovative solutions to deliver business outcomes and build flexible operating models to create competitive advantages and generate value.

During 2020, we continued to add new client logos and significantly expanded relationships with some of the most iconic brands in our client roster as C-suites and Boards looked to improve business outcomes and accelerate their digital transformation agendas in response to the challenges presented by COVID-19. Many of these deals and transitions were executed entirely remotely, building on our years of experience working in a global, technology-enabled environment. As we move forward, we plan to have a mix of in-office, remote, and hybrid delivery models for our global workforce based on client requirements, local regulations, and employee preferences.

During 2020, we completed two acquisitions that strengthened our capabilities in critical areas: digital commerce and data and analytics. We use internal capability development, partnerships, large targeted carve-outs from our clients, and acquisitions to continue to develop and evolve our solutions, allowing us to be differentiated and win in the market.

2020 highlighted the strength and relevance of the strategic choices we have made, and we are pleased with our execution. We believe we are well positioned to continue to help our clients fulfill critical needs and transform their business models over the long-term in the post-pandemic “new normal.”

Our people

Our people remain our most valuable asset. Our culture of agility, flexibility, and exceptional client focus allows us to deliver for our clients regardless of the macroeconomic environment. Our global team truly embodies our purpose and relentlessly pursues better outcomes for our clients and communities.

Our culture of learning fuels our ability to be agile and nimble in serving clients. Powered by our internal learning platform, Genome, we provide our people with the right tools and methods to develop relevant digital transformation and other professional skills at scale. We continue to deepen our expertise and knowledge of the industry domains we serve and the outcome-focused services we offer, including processes bolstered by our Lean Six Sigma heritage. We currently have more than 68,000 active Genome users and have used Genome to train more than 24,000 people on AI and machine learning, 12,600 people on data and analytics, and 10,200 people on customer and user experience. Combined with our internal employee redeployment platform, TalentMatch, we successfully redeployed more than 10,000 colleagues in 2020 to support the changing needs of our clients.

Financial Performance

During 2020, our strong execution, dedication to our clients, and culture of embracing change enabled us to grow revenue and maintain margins in the face of the challenging macroenvironment. We continue to see excellent momentum in Transformation Services which led our growth as we expanded our offerings to meet the demand for digital solutions that we have seen across all industry verticals. This also translated into healthy adjusted diluted earnings per share1 growth.

While our full-year 2020 results came in lower than our initial expectations as a result of COVID-19, we believe our industry-leading revenue growth demonstrates the resilience of our business and the non-discretionary nature of the services we provide for our clients.

Throughout 2020, we grew client relationships, signed new logos, and won new large deals after an elongation of decision-making cycles earlier in the year in reaction to the initial onset of COVID-19. While our exposure to clients adversely impacted by macroeconomic challenges is minimal, we have

1 | Adjusted diluted earnings per share is a non-GAAP measure. See Exhibit 1 to this Proxy Statement for a reconciliation of GAAP diluted earnings per share to adjusted diluted earnings per share. |

demonstrated true partnership with these clients, adjusting our relationships to meet their changed needs while keeping in mind the opportunities to grow in the future. As the environment stabilized later in the year, we recorded our highest quarterly bookings ever in the fourth quarter, positioning us well for future long-term growth.

Our performance through the challenges of 2020 reflects the execution of our strategy focused on a set of industry verticals and service lines and our investments in digital capabilities, experience, data and analytics, and cloud. Our consistent strong execution has also reinforced our credibility as a trusted advisor to our clients.

Here are some highlights from 2020:

• | Total revenue was $3.7 billion, up 5% year-over-year (6% on a constant currency basis);2 |

• | Revenue from Global Clients was $3.3 billion, up 7% year-over-year both on an as reported and constant currency basis,2 representing 88% of total revenue; |

• | New bookings were approximately $3.1 billion, down 20% year-over-year, with Global Client new bookings down 8% year-over-year;3 |

• | Income from operations was $439 million, up 2% year-over-year, with a corresponding margin of 11.8%, and adjusted income from operations was $589 million, up 5% year-over-year, with a corresponding margin of 15.9%;4 and |

• | Diluted earnings per share was $1.57, up 1% year-over-year; adjusted diluted EPS was $2.12, up 3% year-over-year.5 |

Based on the bookings momentum we saw in the fourth quarter of 2020, we expect Global Client revenue to return to our historical pattern of delivering double-digit annual revenue growth by the fourth quarter of 2021.

Driving total shareholder return

We returned $211 million of capital to shareholders in 2020, including approximately $74 million from our regular quarterly dividend and $137 million in share repurchases. Since we instituted our share buyback program in 2015, we have reduced our net shares outstanding by 19%.

Since announcing our focused growth strategy in early February 2014, our total shareholder return (TSR) is approximately 300%.6

Long-term outlook

Given the underpenetrated, large, and expanding total addressable market for our services, as well as our sharp differentiation in driving digital and data analytics-led transformation for our clients, we continue to expect to drive double-digit to low-teens Global Client growth over the long-term.

2 | Revenue growth on a constant currency basis is a non-GAAP measure and is calculated by restating current-period activity using the prior fiscal period’s foreign currency exchange rates adjusted for hedging gains/losses in such period. |

3 | New bookings, an operating measure, represents the total contract value of new contracts and certain renewals, extensions and changes to existing contracts. Regular renewals of contracts with no change in scope are not counted as new bookings. |

4 | Adjusted income from operations and adjusted income from operations margin are non-GAAP measures. See Exhibit 1 to this Proxy Statement for a reconciliation of GAAP income from operations and GAAP net income attributable to Genpact Limited shareholders to adjusted income from operations and GAAP income from operations margin and GAAP net income attributable to Genpact Limited shareholders margin to adjusted income from operations margin. |

5 | Adjusted diluted earnings per share is a non-GAAP measure. See Exhibit 1 to this Proxy Statement for a reconciliation of GAAP diluted earnings per share to adjusted diluted earnings per share. |

6 | Total shareholder return has been calculated as of December 31, 2020. |

After responding to challenges related to COVID-19, we expect to return to our strategic objective of deliberately driving adjusted income from operations margin expansion and balancing long-term profitable growth while still investing meaningfully in our business.

Additional environment, social, and governance (ESG) considerations

2020 reinforced the importance of serving our stakeholders, including our clients, employees, investors, and the communities in which we operate. We are proud to be named a 2021 World’s Most Ethical Company by the Ethisphere Institute for the third time.

Over the last ten years, we have made meaningful strides in promoting a diverse and inclusive workplace with women now representing more than 40% of our global workforce and 45% of our Board of Directors.7 During the year, we also elevated racial equity as a high priority and are building programs to drive change focused on attracting, building, and retaining racially diverse talent.

We have become increasingly focused on sustainability as a corporate priority and are driving initiatives to minimize our climate impact by making our operating facilities greener through increased use of renewable energy, continuous improvement in water consumption, and minimization of waste, including the elimination of non-essential single use plastics and recycling of food waste.

We are committed to our ESG initiatives and to sharing our progress transparently with our stakeholders.

Annual General Meeting

Finally, it is my pleasure to invite you to attend the 20182021 Annual General Meeting of Shareholders of Genpact Limited to be held on Tuesday,Wednesday, May 8, 2018 at the Fairmont Chicago Millennium Park Hotel, 200 N Columbus Drive, Chicago, Illinois 60601.5, 2021. The Annual General Meeting will begin at 10 a.m. local time.12:00 p.m. Eastern Daylight Time. In the interest of the health and safety of our shareholders, employees, and communities, the 2021 Annual General Meeting will be conducted again this year in a virtual meeting format due to the ongoing COVID-19 pandemic.

The enclosed Notice of our 20182021 Annual General Meeting and Proxy Statement provideprovides important information about the matters to be considered and voted upon at the annual meeting. We hope that you will read the enclosed materials and submit your voting instructions by proxy. Voting by proxy will ensure your representation at the annual meeting even if you are unable to attend in person.the meeting. The Board of Directors recommends that you vote FOR each director nominee included in Proposal No. 1 and FOR Proposal Nos. 2 3 and 43 included in the enclosed notice.

Pursuant to the Securities and Exchange Commission rules that allow users to furnish proxy materials to shareholders over the Internet instead of a printed copy of our proxy materials to all of our shareholders, we are providing access to our proxy materials by posting them on the Internet and delivering a Notice Regarding the Availability of Proxy Materials, as more fully described in the accompanying Notice of 2021 Annual General Meeting of Shareholders. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all shareholders. On or about March 25, 2021, we will mail our shareholders a Notice Regarding the Availability of Proxy Materials containing instructions on how to access or request copies of our proxy materials and our Annual Report on Form 10-K for the year ended December 31, 2020.

7 | This includes Tamara Franklin, who has been appointed to the Board effective March 29, 2021. |

Your vote is very important to us. Whether or not you plan to attend the annual meeting, we ask that you vote as soon as possible. Please review the instructions on the Notice Regarding the Availability of Proxy Materials or, if you request printed copies of the proxy materials, the enclosed proxy card regarding each of your voting options.

Thank you for your ongoing support of and continued interest in Genpact.

| |

| Sincerely, |

N.V. “Tiger” Tyagarajan

|

NoticeNOTICE OF 20182021 ANNUAL GENERAL MEETING OF SHAREHOLDERS

Date: |

|

Time: |

|

Virtual Location: |

|

Password: | G2021 |

Our 2021 annual general meeting of shareholders will be held virtually via the Internet at www.meetingcenter.io/285557805 due to the ongoing COVID-19 pandemic. There will not be a physical meeting location for our 2021 annual meeting, and shareholders will not be able to attend the 2021 annual meeting in person. In light of the public health and safety concerns related to the COVID-19 pandemic, we believe that hosting a virtual meeting will enable greater shareholder attendance and participation from any location around the world. Pending the status of the COVID-19 pandemic, we expect to resume holding in-person annual general meetings of shareholders in 2022.

Using the details above, there are two options to log in to the virtual meeting: join as a “Shareholder” or join as a “Guest.”

If you were a shareholder as of the close of business on March 12, 2021 and have your control number, you may join the meeting as a “Shareholder” using the password above. Shareholders who join with their control number will be able to vote and ask questions during the annual meeting by following the instructions available on the meeting website during the meeting. For registered shareholders, the control number can be found on your proxy card or notice, or email you previously received.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the annual meeting and participate as a “Shareholder.” To register, you must submit proof of your proxy power (legal proxy) reflecting your Genpact shareholdings, along with your name and email address to our transfer agent, Computershare. To do this, you must forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com. Requests for registration must be labeled as “Legal Proxy” and be received no later than 2:00 p.m., Eastern Daylight Time, on April 30, 2021. You will receive a confirmation email from Computershare of your registration.

If you do not have a control number, you may still attend as a “Guest” (non-shareholder) but will not have the option to vote your shares or ask questions during the virtual annual meeting.

| (1) | Elect eleven (11) directors to hold office until the next annual election or the election and qualification of their successors; |

| (2) | Approve, on a non-binding, advisory basis, the compensation of our named executive officers; |

| (3) | Approve the |

|

|

|

| Transact such other business as may properly come before the annual meeting or any postponement or adjournment thereof. |

The Board recommends that you vote“ “FOR”FOR” each director nominee included in Proposal No. 1 and “FOR”FOR” Proposal Nos. 2 3 and 4.3. The full text of these proposals is set forth in the accompanying proxy statement.

Shareholders of record at the close of business on March 9, 201812, 2021 are entitled to vote at the annual meeting.

Your vote is important regardless of the number of shares you own.

We have elected to use the notice and access rules adopted by the Securities and Exchange Commission to provide many of our shareholders access to our proxy materials and our Annual Report on Form 10-K by notifying you of the availability of our proxy materials and our Annual Report on Form 10-K via the Internet. The notice and access model provides the Company with a fast, efficient and lower-cost way to furnish shareholders with their proxy materials and reduces our impact on the environment. As a result, on or about March 25, 2021, we will mail our shareholders a “Notice Regarding the Availability of Proxy Materials” (the “Notice”) with instructions for how to access the proxy materials and our Annual Report on Form 10-K via the Internet (or how to request a paper copy) and how to vote online. We will also deliver printed versions of the proxy materials to shareholders who request paper copies of the proxy materials. On the date of mailing of the Notice, all shareholders will be able to access the proxy materials on a website referred to, and at the URL address included in, the Notice and in the proxy statement. These proxy materials will be available free of charge.

Whether you expect to attend the virtual annual meeting or not, please complete, sign, date and promptly return the enclosed proxy card in the postage-prepaid envelope we have provided. You can also submit your proxy to vote your shares over the Internet as provided in the instructions set forth ononline or, if you request printed copies of the proxy card.materials, by mail or telephone. Your prompt response will ensure that your shares are represented at the annual meeting. You can change your vote and revoke your proxy at any time before the polls close at the annual meeting by following the procedures described in the accompanying proxy statement.

Please let us know if you plan to attend the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May | By order of the Board of Directors,

Heather D. White Corporate Secretary

|

Table of Contents

2 | ||

| 2 | |

|

| |

4 | ||

|

| |

| 4 | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Annual Board, Committee and Individual Director Evaluation Process | 8 | |

|

| |

|

| |

|

| |

|

| |

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 11 | |

|

| |

|

| |

| ||

|

| |

|

| |

|

|

|

| ||

|

| |

|

|

|

21 | ||

| 21 | |

|

| |

|

| |

|

| |

| Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table |

|

|

| |

|

| |

|

| |

50 | ||

|

| |

| Termination and Change of Control Potential Payments and Benefits Table |

|

|

| |

| Securities Authorized for Issuance Under Equity Compensation Plans |

|

|

| |

|

| |

|

| |

|

| |

|

|

| ||

|

| |

| Proposal |

|

| Independent Registered Public Accounting Firm Fees and Other Matters |

|

|

|

|

IMPORTANT INFORMATION ABOUT THE ANNUAL GENERAL MEETING AND VOTING |

| |

|

| |

60 | ||

60 | ||

|

| |

|

| |

|

| |

| 60 | |

61 | ||

|

| |

|

| |

|

| |

| 62 | |

|

| |

|

| |

|

| |

| How does the |

|

| Will any other business be conducted at the meeting or will other matters be voted on? |

|

| 63 | |

| 63 | |

|

| |

| Will the |

|

|

| |

|

| |

|

|

|

| ||

|

|

|

| ||

| ||

|

| |

EXHIBIT |

| |

ii | |

|

PROXY STATEMENT FOR ANNUAL GENERAL MEETING OF SHAREHOLDERS

GENPACT LIMITED

Canon’s Court

22 Victoria Street

Hamilton HM 12

Bermuda

May 8, 20185, 2021

This proxy statement contains information about the 20182021 Annual General Meeting of Shareholders of Genpact Limited, which we refer to in this proxy statement as the “annual meeting” or the “meeting.” TheTo support the health and well-being of our shareholders, employees and directors in light of the ongoing COVID-19 pandemic, the annual meeting will be held virtually via the Internet at www.meetingcenter.io/285557805on Tuesday,Wednesday, May 8, 2018, at the Fairmont Chicago Millennium Park Hotel, 200 N Columbus Drive, Chicago, Illinois 60601.5, 2021. The annual meeting will commence at 10 a.m. local12:00 p.m. eastern daylight time. There will not be a physical meeting location for the annual meeting, and shareholders will not be able to attend the annual meeting in person.

This proxy statement is furnished by the board of directors of Genpact Limited, which is also referred to as “Genpact” or the “Company” in this proxy statement, in connection with the solicitation of proxies for use at the annual meeting and at any postponement or adjournment of the annual meeting. All proxies will be voted in accordance with the instructions they contain. If no instruction is specified on a proxy, it will be voted in accordance with the recommendation of our board of directors. The board of directors recommends that you vote FOR each director nominee included in Proposal 1 and FOR Proposals 2 3 and 4.3. A shareholder may revoke any proxy at any time before it is exercised by voting at a later date online or by telephone, by giving our Secretary written notice to that effect either before or atduring the annual meeting, by signing and submitting another proxy with a later date, or by attending the meeting in person and voting such holder’s shares.holder's shares online at the annual meeting.

OurA Notice Regarding the Availability of Proxy Materials with instructions for how to access the proxy materials and our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 is being2020 via the Internet (or how to request a paper copy) and how to vote online will be mailed to shareholders on or about March 25, 2021. If you request a paper copy of the proxy materials, you may also vote by telephone or by mailing a proxy card in accordance with the Notice of 2018 Annual General Meeting andprocess described in the proxy materials.

In this proxy statement we make reference to materials available on our website, www.genpact.com. Our website address is provided for convenience only. We are not including the information on our website, or about April 12, 2018.any information which may be linked through our website, as a part of this proxy statement, nor is it incorporated herein.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 20172020 as filed with the United States Securities and Exchange Commission (the “SEC”"SEC"), except for exhibits, will be furnished without charge to any shareholder upon written request to us c/o Genpact LLC, 1155 Avenue of the Americas, 4th Floor, New York 10036, Attention: Corporate Secretary.

|

|

We believe that good corporate governance is important to ensure that Genpact is managed for the long-term benefit of its shareholders. Our board of directors is responsible for our governance practices and oversight of our strategy, operations and management. Some of the principal responsibilities of the members of our board of directors are to:

exercise their business judgment to promote the long-term interests of the Company’sCompany's shareholders by providing strategic direction to the Company and overseeing management in the performance of the Company’sCompany's business activities;

review, approve and monitor significant financial and business strategies as developed by management;

evaluate the performance of the Company and its executive officers and approve CEO succession plans;plans for our chief executive officer, or CEO; and

review and approve material transactions and corporate activities not entered into in the ordinary course of business.

The board of directors has corporate governance guidelines to assist it in the exercise of its duties and responsibilities and to serve the best interests of our Company and our shareholders. These guidelines, together with our bye-laws, our committee charters and our Code of Ethical Business Conduct, provide a governance framework for the board of directors and its committees.

The board of directors reviews our corporate governance guidelines and other corporate governance documents from time to time and revises them when it believes it serves the interests of the Company and its shareholders to do so and in response to changing regulatory and governance requirements. The following sections provide an overview of our corporate governance practices.

You can obtain the current charters for our audit committee, compensation committee and nominating and governance committee, our corporate governance guidelines and our Code of Ethical Business Conduct at www.genpact.com or we will send you a copy upon request in writing to:

Genpact LLC

1155 Avenue of the Americas, 4th Floor

New York, New York 10036

Attention: Corporate Secretary

2020 Corporate Governance Highlights

Board Refreshment

Appointed two new directors and a new independent Chairman of the Board since our last annual meeting, enhancing the breadth and depth of the skills, experience and diversity of our board of directors.

Shareholder Engagement

Engaged in shareholder outreach to investors representing about 70% of our shares outstanding in 2020. (See “Compensation Discussion and Analysis—Shareholder Engagement” for more information.)

Company Recognitions

Named one of Ethisphere's "World's Most Ethical Companies" for the third time.

Named a “Leader in Sustainability” by Frost & Sullivan and The Energy and Resources Institute.

Winner of the Association for Talent Development’s BEST Award for talent development.

2 |2021 Proxy Statement |

|

CORPORATE GOVERNANCE HIGHLIGHTS

We are committed to governance policies and practices that are designed to serve the best interests of Genpact and our shareholders. Our governance practices and policies include the following, among other things:

All directors elected annually | All of our directors serve one-year terms and are subject to |

Separate CEO and Chairman | We have an independent Chairman of the |

Independent board and committees | All of our directors other than our CEO are independent, and our standing board committees are made up entirely of independent directors. |

Board commitment to diversity and refreshment | Our board of directors is active in succession planning, is committed to refreshment of our board, and has a robust director selection and succession process that is focused on creating a world-class board that is diverse, including with respect to gender, age, race and ethnicity, experience, international exposure, tenure and skills. |

|

|

| 2021 Proxy Statement |3 |

Our bye-laws do not contain supermajority voting requirements except (i) to alter the manner in which the bye-laws may be amended or revoked, (ii) to alter the rights of any class of shares issued and outstanding, (iii) to amend the bye-law defining the events that vacate the office of any sitting director, and (iv) to amend the bye-law concerning the appointment of directors in the event that the board of directors has elected to create a classified board. | |

| Our |

Director and officer share ownership requirements | Our share ownership guidelines require ownership of a number of our common shares with a minimum value |

* See “Important Information about the Annual General Meeting and Voting—How and when may I submit a shareholder proposal, including a shareholder nomination for director, for the 2019 annual general meeting?” on page 64 for information about submitting proposals for consideration at our next annual meeting. See also the section titled “Director Nomination Process”

* | See "Important Information about the Annual General Meeting and Voting—How and when may I submit a shareholder proposal, including a shareholder nomination for director, for the 2022 annual general meeting?" on page 63 for information about submitting proposals for consideration at our next annual meeting. See also the section titled "Director Nomination Process and Director Characteristics" below for information about how to propose a director nominee for election to our board. |

Information regarding our sustainability, environmental, social, and human capital management activities is available in our “Genpact Sustainability Report” posted on our website. We have been issuing Sustainability Reports every other year since our first publication in 2011 and beginning in 2021 will be publishing our Sustainability Report annually. We encourage you to learn more about our many sustainability initiatives and our progress towards meeting our goals, including with respect to human capital management, by reviewing our “Genpact Sustainability Report” located on the Corporate Governance section of our website at genpact.com/investors. Our website address is provided for convenience only. We are not including the information on our website, or any information which may be linked through our website, such as our Sustainability Report, as a part of this proxy statement, nor is any such information incorporated herein.

Pursuant to the corporate governance listing standards of the New York Stock Exchange (“NYSE”("NYSE"), a director employed by us cannot be deemed to be an “independent"independent director,”" and consequently Mr. Tyagarajan is not an independent director. The board has determined that none of the other current directorsdirector nominees has a material relationship with us for purposes of the NYSE corporate governance listing standards and accordingly each is independent under such NYSE standards. In making its

|

|

independence determinations, the board considered the relationship between our Company and Bain Capital, as affiliates of Bain Capital own approximately 21% of our outstanding common shares, the fact that Messrs. Chandra, Humphrey and Nunnelly serve on our board as designees of Bain Capital pursuant to the terms of our shareholder agreement with affiliates of Bain Capital, and the fact that Messrs. Chandra and Humphrey are managing directors of Bain Capital.

DIRECTOR NOMINATION PROCESS AND DIRECTOR CHARACTERISTICS

In considering whether to recommend any particular candidate for inclusion in the board of directors’directors' slate of recommended director nominees, the nominating and governance committee applies the criteria set forth in our Corporate Governance Guidelines. These criteria include the candidate’scandidate's integrity, knowledge of our business and industry, experience, diligence, absence of any conflicts of interest and the ability to act in the interests of all shareholders. The committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the board of directors to fulfill its responsibilities. We

4 |2021 Proxy Statement |

|

While we do not have a formal or informal diversity policy for board membership, but the nominating and governance committee is committed to considering diversity in accordance with its charter.charter, and it seeks out candidates with diverse experience and perspectives, including diversity with respect to gender, age, race, ethnicity, geography, and areas of expertise. The nominating and governance committee and the board of directors believe that considering diversity is consistent with the goal of creating a board of directors that best serves the needs of the Company and the interests of its shareholders, and it is one of the many factors that they consider when identifying individuals for Board membership. When considering candidates as potential Board members, the Board and the nominating and governance committee evaluate each candidate's ability to contribute to the diversity of the Board.

The nominating and governance committee and the Board also believe that diversity with respect to tenure is important in order to balance the fresh perspectives brought by newer directors with the deep institutional knowledge and experience of our longer tenured directors. Our director nominees have an average tenure of six years. Our shortest-serving director nominee has just been appointed to our Board effective March 29, 2021, and our longest-serving director nominee has served on our Board for 16 years. In the past 24 months, we have added four new directors to our board of directors, replacing four directors who completed their impactful tenures on our board.

Select characteristics of our director nominees are set forth below:

5 of our 11 director nominees (45%) are women |

5 of the 7 newest directors on our board (71%) are women |

3 of our 11 director nominees are racially diverse |

6 of the 7 newest directors on our board are either women or racially diverse |

The average age of our director nominees is 60 (age range of 51 — 75) |

Our board nominees have an average board tenure of 6 years |

2 of our 4 newest director nominees spent their careers outside the U.S. |

Shareholders may recommend individuals to the nominating and governance committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials, including information regarding the number of shares owned by any potential director candidate, and a statement as to whether the shareholder or group of shareholders making the recommendation has beneficially owned more than 5% of our common shares for at least a year as of the date such recommendation is made, to the Secretary of the Company, c/o Genpact LLC, 1155 Avenue of the Americas, 4th4th Floor, New York, NY 10036. Assuming that appropriate biographical and background material has been provided on a timely basis, the nominating and governance committee will evaluate shareholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

MEETINGS OF THE BOARD OF DIRECTORS

The board of directors has responsibility for establishing broad corporate policies and reviewing our overall performance rather than day-to-day operations. The board of directors’directors' primary responsibility is to oversee the management of Genpact and, in so doing, serve the best interests of the Company. Subject to the recommendations of the compensation committee and the nominating and governance committee, respectively, the board of directors selects, evaluates and provides for the succession of executive officers, and the board of directors nominates for election at annual general shareholder meetings individuals to serve as directors of Genpact and elects individuals to fill any vacancies on the board of directors to the extent not filled by shareholders in general meetings. ItThe board of directors reviews and approves corporate objectives and strategies, and evaluates significant policies and proposed major commitments

| 2021 Proxy Statement |5 |

of corporate resources. Management keeps the directors informed of Company activity through presentations at board of directors and committee meetings.

The board of directors met, in person or telephonically, 1214 times in 2017.2020. During 2017,2020, each of our directors attended 75% or more of the total number of meetings of the board of directors and the committees of which such director was a member during the period of time he or she served on such committee. Our Corporate Governance Guidelines set forth our policy that directors are expected to attend annual general meetings of shareholders. All of our directors standing for re-election at the 2021 annual meeting who were serving in such capacityon our board of directors at the time of the 20172020 annual meeting attended the 20172020 annual meeting.

|

|

COMMITTEES OF THE BOARD OF DIRECTORS

The board of directors has standing audit, compensation and nominating and governance committees. Each committee has a charter that has been approved by the board of directors. Each committee must review the appropriateness of its charter and perform a self-evaluation at least annually. Mr. Tyagarajan is the only director who is an employee of Genpact, and he does not participate in any meeting, or portions of any meeting, at which his compensation or performance is evaluated. All members of all committees are non-employee directors and the board of directors has determined that all of the members of our three standing committees are independent as defined under the rules of the NYSE, and, in the case of all members of the audit committee, the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act.Act of 1934, as amended.

The table below sets forth the committees of our board, the composition of each committee and the number of meetings of each committee during 2017.2020.

|

| BOARD COMMITTEES |

| BOARD COMMITTEES | ||||||||

Board Member |

| Audit |

| Compensation |

| Nominating and Governance |

| Audit |

| Compensation |

| Nominating and |

Amit Chandra |

|

|

|

|

| Member | ||||||

Ajay Agrawal |

|

|

|

|

| Member | ||||||

Stacey Cartwright |

| Member |

|

|

|

| ||||||

Laura Conigliaro |

| Member |

|

|

|

|

| Member |

|

|

| Member |

Carol Lindstrom |

|

|

| Member |

|

|

|

|

| Member |

| Chair |

James Madden |

|

|

| Member |

| Chair | ||||||

Alex Mandl(1) |

| Chair |

|

|

|

| ||||||

James Madden(1) |

|

|

| Member |

| Member | ||||||

CeCelia Morken |

| Member |

|

|

|

|

| Member |

| Member |

|

|

Mark Nunnelly |

|

|

| Chair |

|

|

|

|

| Chair |

|

|

Robert Scott(2) |

| Member |

| Member |

| Member | ||||||

Brian Stevens |

| Member |

|

|

|

| ||||||

Mark Verdi |

| Member |

|

|

|

|

| Chair |

|

|

|

|

Number of meetings in 2017 |

| 7 |

| 6 |

| 2 | ||||||

Number of meetings in 2020 |

| 9 |

| 7 |

| 5 | ||||||

| (1) | Mr. Madden currently serves as Chairman of the board of directors. |

(2) | Audit committee financial expert as defined by SEC rules. |

|

|

|

|

The tables below set forth the primary responsibilities of each committee of our board. The lists of responsibilities set forth below are not exhaustive. A complete list of each committee’scommittee's responsibilities can be found in the charter for each committee, available on our website, www.genpact.com.

6 |2021 Proxy Statement |

|

MEMBERS(1)

Stacey Cartwright Laura Conigliaro CeCelia Morken

| PRIMARY RESPONSIBILITIES

• • the performance of any registered public accounting firm employed by us to provide audit services, including such • the quality and integrity of our accounting and reporting practices and controls, including our financial statements and reports; • the performance of our internal audit function; and • our compliance with legal and regulatory requirements.

• • Reviewing and discussing with management our major financial, data privacy and cybersecurity and other significant risk exposures and the steps management has taken to monitor and control such exposures. • Reviewing and approving related party transactions. • Overseeing our compliance program • Establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by

• Reporting regularly to our full board of directors with respect to the foregoing. |

| (1) | The board has determined that each member of the audit committee meets the financial literacy and independence requirements of the SEC and the NYSE applicable to audit committee members. |

| (2) | Mr. |

MEMBERS(1) Mark Nunnelly (Chair) Carol Lindstrom James Madden

CeCelia Morken | PRIMARY RESPONSIBILITIES

• •Reviewing and approving compensation for our directors, including the

|

| (1) | The board has determined that each member of the compensation committee meets the independence requirements of the SEC and NYSE applicable to compensation committee members. |

| 2021 Proxy Statement | |

|

Nominating and GovernanceGovernance Committee

MEMBERS(1) Carol Lindstrom (Chair) Ajay Agrawal Laura Conigliaro James Madden

| PRIMARY RESPONSIBILITIES • • • • • •

• |

| (1) | The board has determined that each member of the nominating and governance committee meets the independence requirements of the SEC and NYSE applicable to nominating and governance committee members. |

The positions of chairmanChairman of the board of directors and Chief Executive OfficerCEO have historically been separated at Genpact. Keeping these positions separate allows our Chief Executive OfficerCEO to focus on our day-to-day business, while allowing the chairmanChairman of the board of directors to lead the board in its exercise of business judgment to promote the long-term interests of our shareholders by providing strategic direction and overseeing management. The Boardboard of directors believes that keeping these positions separate is the appropriate leadership structure for us at this time.

ANNUAL BOARD, COMMITTEE AND INDIVIDUAL DIRECTOR EVALUATION PROCESS

As set forth in its charter, the nominating and governance committee oversees the board, committee and individual director evaluation process. Annually, the nominating and governance committee determines the appropriate form of evaluation and considers the design of the process to ensure it is both meaningful and effective.

From time to time, the board of directors engages an independent third party with experience in board evaluations and organizational effectiveness to lead the board evaluation. The last time the board engaged a third party to lead the board evaluation process was in 2019. In 2020, the board led its own self-evaluation process, which included written evaluations of the board as a whole, each committee and individual directors and was led by the Chair of the nominating and governance committee. The process also included one-on-one interviews between the Chair of the nominating and governance committee and each other member of the board. The evaluation process engaged our directors on a wide range of topics, including board and committee structure, board dynamics and operations, and board, committee and individual director effectiveness and performance. Following the conclusion of the evaluation process, the board reviewed and discussed the evaluation results and, in response, established certain agenda items for the board and its committees to act upon in 2021.

The results of the 2020 evaluation process support the board’s belief that the board and its committees are operating effectively.

Our management is responsible for risk management on a day-to-day basis, and our board and its committees oversee the risk management activities of management. The Audit Committeeaudit committee assists the board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, cybersecurity, internal controls and compliance with legal and regulatory requirements, and, in accordance with NYSE requirements, discusses policies with respect to risk assessment and risk management. The Compensation Committeecompensation committee assists the board in fulfilling its oversight responsibilities

8 |2021 Proxy Statement |

|

with respect to the management of risks arising from our compensation policies and programs.programs and succession planning for our executive officers. The Nominatingnominating and Governance Committeegovernance committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors and executive officers, and corporate governance.

COMMUNICATING WITH THE INDEPENDENT DIRECTORS

The board of directors will give appropriate attention to written communications that are submitted by shareholders and other interested parties, and will respond if and as appropriate. The nominating and governance committee, with the assistance of the Company’s General Counsel,Company's Chief Legal Officer, is primarily responsible for monitoring communications from shareholders and other interested parties and for providing copies or summaries to the other directors as its members consider appropriate. Our non-executive chairman,Chairman, Mr. Scott,Madden, serves as the presiding director at all executive sessions of our non-management directors.

|

|

Communications will be forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the nominating and governance committee considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which the Company may receive repetitive or duplicative communications.

Shareholders and interested parties who wish to send communications on any topic to the board of directors should address such communications to:

Board of Directors

Genpact Limited

c/o Genpact LLC

1155 Avenue of the Americas, 4th Floor

New York, New York 10036

Attention: Corporate Secretary

CODE OF ETHICAL BUSINESS CONDUCT

Our board of directors has adopted a code of ethical business conduct applicable to our directors, officers and employees in accordance with applicable rules and regulations of the SEC and the NYSE. The code is posted on our website at www.genpact.comunder the heading “Investors—Corporate Governance.” We will also provide a copy of the code to shareholders upon request. We disclose any material amendments to our code of ethical business conduct, as well as any waivers for executive officers or directors, on our website.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Our board of directors has adopted written policies and procedures for the review of any transaction, arrangement or relationship in which Genpact Limited is a participant, the amount involved exceeds $1,000,000 (or such lower threshold as our audit committee may from time to time determine),$120,000, and one of our officers, directors, director nominees or 5% shareholders (or their immediate family members), each of whom we refer to as a “related"related person,”" has a direct or indirect material interest.

If a related person proposes to enter into such a transaction, arrangement or relationship, which we refer to as a “related"related person transaction,”" the related person must report the proposed related person transaction to our General Counsel. The policy calls for the proposed related person transaction to be reviewed and, if deemed appropriate, approved by the board’sboard's audit committee. Whenever practicable, the reporting, review and approval will occur prior to entry into the transaction. If advance review and approval is not practicable, the audit committee will review, and, in its discretion, may ratify the related person transaction. The policy also permits the chair of the audit committee to review and, if deemed appropriate, approve proposed related person transactions that arise between committee meetings, subject to ratification by the audit committee at its next meeting. Any related person transactions that are ongoing in nature will be reviewed annually.

| 2021 Proxy Statement |9 |

A related person transaction reviewed under the policy will be considered approved or ratified if it is authorized by the audit committee after full disclosure of the related person’sperson's interest in the transaction. The audit committee will review and consider such information regarding the related person transaction as it deems appropriate under the circumstances.

The audit committee may approve or ratify the transaction only if the audit committee determines that, under all of the circumstances, the transaction is in the Company’sCompany's best interests. The audit committee may impose any conditions on the related person transaction that it deems appropriate.

|

|

In addition to the transactions that are excluded by applicable SEC rules, the board has determined that the following transactions do not create a material direct or indirect interest on behalf of related persons and, therefore, are not related person transactions for purposes of this policy:

interests arising solely from the related person’spersons position as an executive officer of another entity (whether or not the person is also a director of such entity) that is a participant in the transaction, where (a) the related person and all other related persons own in the aggregate less than a 10% equity interest in such entity, (b) the related person and his or her immediate family members are not involved in the negotiation of the terms of the transaction and do not receive any special benefits as a result of the transaction, (c) the amount involved in the transaction equals less than the greater of $1 million dollars or 2% of the annual consolidated gross revenues of the other entity that is a party to the transaction, and (d) the amount involved in the transaction equals less than 2% of our annual gross revenues; and

a transaction that is specifically contemplated by provisions of our charter or bye-laws.

Shareholder Agreement

The shareholder agreement among us and Bain Capital and its co-investors provides that Bain Capital has the right to designate for nomination four directors to our board, so long as Bain Capital maintains certain minimum shareholding thresholds, and the shareholders party to the agreementWe did not have agreed to vote their shares for the election of such persons. The number of directors that Bain Capital is entitled to designate for nomination is reduced if its ownership of our common shares declines below certain levels and such right ceases if such ownership falls below 7.5% of our outstanding common shares, and also may be increased in certain circumstances. As of December 31, 2017, given the size of its shareholding, Bain Capital is entitled to designate for nomination three directors pursuant to the shareholder agreement.

Subject to certain conditions and with certain exceptions, the shareholder agreement grants Bain Capital the right to require us to register for public resale under the Securities Act of 1933 all common shares that it requests be registered. In addition, subject to certain conditions and with certain exceptions, the shareholder agreement grants Bain Capital piggyback rights on any registration for our account or the account of any other holder of our common shares. These rights are subject to certain limitations, including customary cutbacks and other restrictions. In connection with our initial public offering or the other registrations described above, we have and will indemnify any selling shareholders against liabilities resulting from violations of federal or state securities laws by us in connection with any registration statement, prospectus or other disclosure statement used in connection with any registration of our securities and, subject to certain exceptions, we will bear all fees, costs and expenses, except underwriting discounts and selling commissions.

Prior to the one-year anniversary of the date when Bain Capital’s ownership of our common shares falls below 7.5%, Bain Capital is subject to certain restrictions with respect to the acquisition of additional securities of, and certain exercises of control over, including making any offers for the purchase of, the Company. Notwithstanding the foregoing, the shareholder agreement grants Bain Capital the right to maintain its percentage ownership in the event we issue additional securities by purchasing a percentage of any additional securities we issue.

The shareholder agreement also contains provisions regarding corporate opportunities under which directors nominated by Bain Capital pursuant to the shareholder agreement are not required to present to us certain corporate opportunities.

Expense Reimbursement Agreement

Pursuant to an expense reimbursement agreement between us and Bain Capital Partners, LP entered into on March 3, 2015, we have agreed to reimburse Bain Capital Partners, LP and its affiliates for reasonable out-of-pocket expenses incurred by their respective representatives in connection with

|

|

certain financial, managerial, operational or strategic advice or other services provided to us by Bain Capital Partners, LP since January 1, 2013, and as may be mutually agreed from time to time by the Company and Bain Capital Partners, LP. The expense reimbursement agreement also provides for our indemnification of Bain Capital Partners, LP, Bain Capital Investors, LLC and their respective affiliates and representatives subject to certain terms and conditions. The initial term of the expense reimbursement agreement ran until December 31, 2015, with automatic annual renewals thereafter unless either party chooses not to extend the term. In addition, the expense reimbursement agreement may be terminated at any time by either party. Affiliates of Bain Capital Partners, LP currently own approximately 21% of our common shares outstanding. We have reimbursed a total of $47,952 for expenses incurred in 2017 pursuant to the expense reimbursement agreement.

Acquisition of Rage Frameworks

On March 14, 2017, we acquired all of the outstanding equity interest in Rage Frameworks, Inc., a leader in knowledge-based automation technology and services providing artificial intelligence for companies. The purchase price we paid for the acquisition of Rage Frameworks was approximately $125 million. Mark Nunnelly, one of our directors and a member of our compensation committee, was a minority shareholder of Rage Frameworks at the time of closing and received less than 1% of the purchase price as consideration for his equity interests. Our board of directors reviewed and approved this transaction in accordance with the policies and procedures for related person transactions described above, and Mr. Nunnelly recused himself from all board discussions concerning Rage Frameworks, including the vote to approve the transaction.in 2020.

Secondary Offerings

On August 18, 2017, we completed a secondary offering of our common shares pursuant to our shareholder agreement with affiliates of Bain Capital described above. In an underwritten public offering, certain affiliates of Bain Capital, together with their co-investor, GIC Private Limited (the “Selling Shareholders”), sold 10.0 million of our common shares at a price of $28.72 per share. All of the common shares were sold by the Selling Shareholders and, as a result, we did not receive any of the proceeds from the offering.

On November 20, 2017, in accordance with the shareholder agreement, we completed an additional secondary offering of our common shares pursuant to which the Selling Shareholders sold 10.0 million of our common shares at a price of $30.26 per share in an underwritten public offering. All of the common shares were sold by the Selling Shareholders and, as a result, we did not receive any of the proceeds from the offering.

10 | |

|

Security Ownership of Certain Beneficial Owners and Management

The following table contains information regarding the beneficial ownership of our common shares as of March 9, 201812, 2021 by:

each shareholder we know to own beneficially more than 5% of our outstanding common shares;

each director;director nominee;

each executive officer named in the 20172020 Summary Compensation Table under the heading “Information about Executive and Director Compensation;”Table; and

all of our directorsdirector nominees and executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Common shares subject to options that are currently exercisable or are exercisable within 60 days of March 9, 201812, 2021 are deemed to be outstanding and beneficially owned by the person holding such options. Such shares, however, are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person. Percentage of beneficial ownership is based on 192,109,536187,149,112 common shares of Genpact Limited outstanding on March 9, 2018.12, 2021.

Name of Beneficial Owner(1) |

| Number of |

| Percentage of | |

Known 5% Beneficial Owners | |||||

Glory Investments A Limited(3) |

| 40,538,196 |

| 21.10% | |

Wellington Management Group, LLP(4) |

| 21,304,663 |

| 11.09% | |

BlackRock, Inc.(5) |

| 12,772,040 |

| 6.65% | |

The Vanguard Group(6) |

| 12,526,416 |

| 6.52% | |

Brown Advisory Incorporated(7) |

| 12,298,926 |

| 6.40% | |

Nalanda India Equity Fund Limited(8) |

| 10,817,735 |

| 5.63% | |

FMR LLC(9) |

| 10,668,949 |

| 5.55% | |

Directors and Executive Officers | |||||

N.V. Tyagarajan(10) |

| 2,373,057 |

| 1.24% | |

Edward J. Fitzpatrick(11) |

| 186,926 |

| * | |

Patrick Cogny(12) |

| 140,574 |

| * | |

Arvinder Singh(13) |

| 169,569 |

| * | |

Mohit Thukral(14) |

| 141,938 |

| * | |

Amit Chandra(15) |

| 25,326 |

| * | |

Laura Conigliaro(16) |

| 36,831 |

| * | |

David Humphrey(17) |

| 27,620 |

| * | |

Carol Lindstrom(18) |

| 9,144 |

| * | |

James Madden(19) |

| 4,700 |

| * | |

Alex Mandl(20) |

| 35,950 |

| * | |

CeCelia Morken(21) |

| 12,172 |

| * | |

Mark Nunnelly(22) |

| 27,620 |

| * | |

Robert Scott(23) |

| 103,162 |

| * | |

Mark Verdi(24) |

| 27,620 |

| * | |

Current Directors and Executive Officers as a group (17 persons) |

| 3,618,406 |

| 1.88% | |

Name of Beneficial Owner(1) |

| Number of Shares Beneficially Owned(2) |

| Percentage of | ||

Known 5% Beneficial Owners | ||||||

FMR, LLC(3) |

| 26,672,247 |

|

| 14.25 | % |

Wellington Management Group, LLP(4) |

| 25,665,661 |

|

| 13.71 | % |

The Vanguard Group(5) |

| 16,516,951 |

|

| 8.83 | % |

Brown Advisory Incorporated(6) |

| 13,855,970 |

|

| 7.40 | % |

Nalanda India Equity Fund Limited(7) |

| 13,143,983 |

|

| 7.02 | % |

|

|

|

|

| ||

Directors and Named Executive Officers | ||||||

N.V. Tyagarajan(8) |

| 3,223,882 |

|

| 1.72 | % |

Edward J. Fitzpatrick(9) |

| 322,409 |

|

| * | |

Balkrishan Kalra(10) |

| 292,390 |

|

| * | |

Darren Saumur(11) |

| 64,096 |

|

| * | |

Kathryn Stein(12) |

| 46,643 |

|

| * | |

Ajay Agrawal(13) |

| 11,212 |

|

| * | |

Stacey Cartwright(14) |

| 5,112 |

|

| * | |

Laura Conigliaro(15) |

| 49,230 |

|

| * | |

Tamara Franklin |

| — |

|

| * | |

Carol Lindstrom(16) |

| 18,079 |

|

| * | |

James Madden(17) |

| 20,604 |

|

| * | |

CeCelia Morken(18) |

| 27,774 |

|

| * | |

Mark Nunnelly(19) |

| 40,019 |

|

| * | |

Brian Stevens(20) |

| 5,112 |

|

| * | |

Mark Verdi(21) |

| 40,019 |

|

| * | |

All Director Nominees and Executive Officers as a group (18 persons) |

| 4,468,605 |

|

| 2.39 | % |

|

| Number of shares represents less than 1% of outstanding common shares. |

|

|

| (1) | Unless noted otherwise, the business address of each beneficial owner is c/o Genpact Limited, Canon’s Court, 22 Victoria Street, Hamilton, HM 12, Bermuda. |

| (2) | Beneficial ownership is determined in accordance with the rules of the SEC and includes voting and/or investment power with respect to the shares shown as beneficially owned. |

| (3) | Based solely on a Schedule |

| (4) | Based solely on a Schedule 13G/A filed with the SEC on February |

| 2021 Proxy Statement |11 |

| (6) | Based solely on a Schedule 13G/A filed with the SEC on February 8, |

|

|

|

| Based solely on a Schedule 13G filed with the SEC on |

|

|

|

| This amount includes options to purchase |

(9) | This amount includes options to purchase 250,000 shares that are exercisable within 60 days and 72,409 shares held directly by Mr. Fitzpatrick. |

(10) | This amount includes options to purchase 207,280 shares that are exercisable within 60 days and 85,110 shares held directly by Mr. Kalra. |

| (11) | This amount includes options to purchase |

| (12) | This amount includes options to purchase |

| (13) | This amount includes |

|

|

|

|

|

| This amount includes |

|

| This amount includes |

|

| This amount includes |

|

| This amount includes |

|

|

|

|

|

| This amount includes |

|

| This amount includes |

|

| This amount includes |

(21) | This amount includes 34,907 shares held directly by Mr. Verdi and 5,112 vested restricted share units, the shares underlying which will be issued on December 31, 2021. |

12 | |

|

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors, executive officers and the holders of more than 10% of our common shares to file with the SEC initial reports of ownership of our common shares and other equity securities on a Form 3 and reports of changes in such ownership on a Form 4 or Form 5. Executive officers, directors and 10% shareholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based on our review of copies of reports filed with the SEC and except as set forth in the above table, we do not believe that there are currently any beneficial owners of more than ten percent of our common shares.

Based solely on our review of copies of reports filed by our directors and executive officers with the SEC or written representations from such persons pursuant to Item 405 of Regulation S-K, we believe that during the fiscal year ended December 31, 2017, all filings required to be made by our directors and executive officers pursuant to Section 16(a) with respect to Genpact Limited securities were made in accordance with Section 16(a).

|

|

Our board of directors currently consists of eleven members.members, including Tamara Franklin, who was appointed to serve on our board effective March 29, 2021. The nominating and governance committee of the board of directors has recommended to the board of directors, and the board of directors has nominated, the eleven persons whose biographies appear below for election as directors with terms expiring at the 20192022 annual meeting. Unless a contrary direction is indicated, it is intended that proxies received will be voted for the election as directors of the eleven nominees, each to serve for a one-year term until their successors are elected or the incumbent resigns. Each of the nominees has consented to being named in this Proxy Statement and to serve as a director if elected. In the event any nominee for director declines or is unable to serve, there will be a vacancy created on the board of directors, which the board of directors may fill on the recommendation of the nominating and governance committee.

Set forth below is certain biographical information as of the date of this proxy statement about each nominee for election to our board of directors, including information each nominee has given us about his or her age, his or her principal occupation and business experience for the past five years, and the names of other publicly held companies of which he or she has served as a director in the past five years. The information presented reflects the specific experience, qualifications, attributes and skills that led the board to conclude that each of these individuals is well-suited to serve on our board. Information about the number of common shares beneficially owned by each current director appears above under the heading “Security Ownership of Certain Beneficial Owners and Management.”

|

|

| ||||

|

| Director Since: 2011 Age:

|

|

|

| Director Since: Age: INDEPENDENT

Committees: Nominating and Governance, Compensation |

• President and Chief Executive Officer, Genpact (2011 to present) • Chief Operating Officer, Genpact (2009-2011) • Executive Vice President, Sales, Marketing, and Business Development, Genpact (2005-2009)

• Extensive knowledge of our industry and business and service as our Chief Executive Officer. |

|

• • • • Special Advisor, General Atlantic LLC (2005-2007) • Chairman and

PAST PUBLIC COMPANY BOARDS • •

•

| ||||

| 2021 Proxy Statement | |

|

|

| |||||

|

| Director Since: Age: INDEPENDENT

Committees: NominatingandGovernance |

|

|

| Director Since: Age: INDEPENDENT

Committees: Audit |

• • • Founder, Brainmaven Corp. (October 2018 to present) • Assistant Professor, Queens University (prior to 2003) QUALIFICATIONS FOR BOARD SERVICE • Extensive knowledge of and expertise in new technologies, including artificial intelligence, relevant to our strategic business plan. | | PROFESSIONAL EXPERIENCE • Chief Executive Officer, Harvey Nichols Group Ltd (2014-2018) • EVP and Chief Financial Officer, Burberry Group plc (2004-2013) • Chief Financial Officer, Egg plc (1999-2003) • Granada plc (various positions) (1988-1999) • Pricewaterhouse UK (various positions) (1985-1988) CURRENT PUBLIC COMPANY BOARDS • Savills plc • Aercap Holdings N.V.

PAST PUBLIC COMPANY BOARDS •

• Experience leading and transforming, and serving as a director on the boards of, other public | ||||

Laura Conigliaro | Tamara Franklin | |||||

| Director Since: 2013 Age: 75 INDEPENDENT Committees: Audit, Nominating and Governance |

|

|

|

Age: 54 INDEPENDENT | |

PROFESSIONAL EXPERIENCE • Partner, Co-director, • Analyst, Prudential Securities (1979-1996)

PAST PUBLIC COMPANY BOARDS ● ● ●

• Extensive knowledge of the financial services and technology industries and service on other public company boards.

| PROFESSIONAL EXPERIENCE • Chief Digital, Data & Analytics Officer, Marsh LLC (2020 to present) • Chief Digital Officer/Vice President, Media & Entertainment, North America, IBM (2017-2020) • Executive Vice President, Digital, Scripps Networks Interactive (2009-2016) QUALIFICATIONS FOR BOARD SERVICE • Extensive experience at large companies driving digital transformation initiatives across technology, data and analytics. * Ms. Franklin has been appointed to the Board effective March 29, 2021. | |||||

|

|

|

| |||||

|

|

|

| Director Since: 2016 Age: INDEPENDENT

Committees: Compensation, Nominating and Governance (Chair) | ||

|

| Director Since: 2016 Age: 63 INDEPENDENT Committees: Audit, Compensation | ||||

|

• Vice Chairman, Deloitte LLP; President, Deloitte Foundation; Director, Deloitte & Touche LLP Board (1995-2016) • Partner, Andersen Consulting

CURRENT PUBLIC COMPANY BOARDS •

• Energous Corporation QUALIFICATIONS FOR BOARD SERVICE • Extensive experience in the fields of technology and | |||||

|

|

| ||||||||

|

| |

|

| ||||

• •

|

| |||||||

|

| |||||

|

|

|

| |||

• Executive Vice President and General Manager, Strategic Partner Group, Intuit Inc. (2013 to • General Manager, Intuit Financial Services Division, Intuit Inc. (2002-2013) • Senior Vice President, WebTone Technologies (1999-2002) • Senior Vice President, retail lending, Fortis Investments (1998-1999) • Senior Vice President; various positions, John H. Hartland Co. (1983-1998)

• Experience in finance and accounting, sales and marketing, | ||||||

Mark Nunnelly | Brian Stevens | |||||

| Director Since: 2012 Age: 62 INDEPENDENT Committees: Compensation (Chair) |

|

|

|

Age: 57 INDEPENDENT Committees: Audit | |

PROFESSIONAL EXPERIENCE • Chairman, AVALT Holdings (2018 to present) • Secretary, Executive Office of Technology Services and Security, Commonwealth of Massachusetts (2017 to • Commissioner of Revenue, Commonwealth of Massachusetts (2015-2017) • Managing Director, Bain Capital (1989-2014)

PAST PUBLIC COMPANY BOARDS • • Dunkin' Brands Group, Inc.

QUALIFICATIONS FOR BOARD SERVICE • | PROFESSIONAL EXPERIENCE • Executive Chairman, Neural Magic (2019 to present) • Vice President and Chief Technology Officer, Google Cloud (2014-2019) • Chief Technology Officer and Executive Vice President of Worldwide Engineering, Red Hat, Inc. (2001-2014) CURRENT PUBLIC COMPANY BOARDS • Nutanix, Inc. QUALIFICATIONS FOR BOARD SERVICE • Experience as a chief technology officer and expertise in software engineering, cloud, open source, virtualization and machine learning. | |||||

| 2021 Proxy Statement | |

|

| ||||||

|

| Director Since: 2012 Age: INDEPENDENT

Committees: Audit (Chair) |

|

| ||

|

| |||||

• Partner, AVALT Holdings (2015 to present) • President, C&S Wholesale Grocers, Inc. (2014-2015) • Managing Director, Bain Capital (2004-2014) • Head of financial services business transformation outsourcing group, IBM Global Services (prior to 2004)

PAST PUBLIC COMPANY BOARDS • Burlington Stores, Inc. • Trinseo S.A.

• Extensive experience in our | |

| ||||

There are no family relationships among any of the directors and executive officers of Genpact. Messrs. Chandra, Humphrey and Nunnelly serve on our board as designees of Glory Investments A Limited, an affiliate of Bain Capital Investors, LLC, or Bain Capital, pursuant to the shareholder agreement described in “Certain Relationships and Related Party Transactions—Shareholder Agreement.” Other than such arrangement, noNo arrangements or understandings exist between any director or any person nominated for election as a director and any other person pursuant to which such person is to be selected as a director or nominee for election as a director.

Proposal 1 – election of directors

BOARD RECOMMENDATION: The board of directors believes that approval of the election of all nominees listed above is in the Company’sCompany's best interests and the best interests of our shareholders and therefore recommends a vote FOR all of these nominees.

|

|

The compensation committee, which is comprised solely of independent directors, reviews and approves the compensation arrangements for our directors.

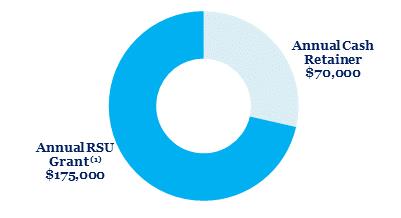

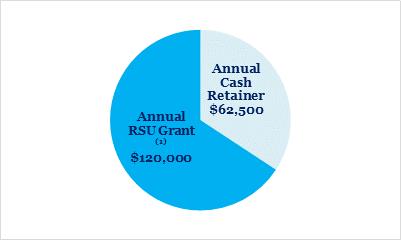

In connection with its 2019 review of director compensation, the compensation committee considered the results of an independent analysis on director compensation prepared by FW Cook, an independent, external compensation consulting firm. As part of this analysis, FW Cook reviewed non-employee director compensation trends and data from companies comprising the same executive compensation peer group used by the compensation committee in connection with its review of CEO compensation in 2018. After considering the information contained in the FW Cook report, the compensation committee recommended and the board approved the following changes to our director compensation program effective January 1, 2020 to align director compensation levels within the market median range:

Increased the base annual cash retainer for non-employee directors from $62,500 to $70,000;

Increased the committee chair retainers for the compensation and nominating and governance committees by $5,000 annually;

Eliminated the sign-on restricted share unit (“RSU”) grant with a value of $180,000, a one-time award previously granted to new non-employee directors upon joining the board; and